专业生产HDPE、ABS、PET、PS、PP等各种材质的厚片及薄片吸塑制品

产品优势

品质保障

技术团队

服务优势

原料,严格质检,黄金品质把控、材质齐全,款式颜色丰富。

无锡百永胶盒厂原料来源于专业供应商,原材料有保障!

无锡百永吸塑包装产品严格遵循质量标准,把控每个生产环节,终检合格方可出货!

一直致力为客户创造商业价值,提供增值服务,共创三赢!

工厂生产加工,价格实惠。

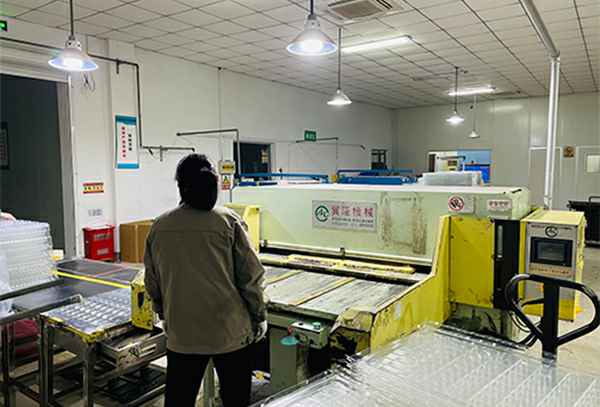

好品质=规范的生产+严格的管控

本公司立下承诺,以人为本,品质第一,全面管理,诚信服务

纸托车间,美观大方。

我们的一切努力都是为了让您满意。

质量层层把关、没有质量检测手段的产品不准生产

严格作到不接受不合格品、不漏检不合格品、不传送不合格品;

确保经过每位员工之手加工的吸塑包装制品达到国家标准合格率;

便于现代化管理、节省人力、提高效率;

打造行业内顶级品质的生产理念为客户提供贴心的服务。

公司普通无尘生产车间建筑面积2000㎡,并配有200 ㎡十万级无尘室,以满足高端客户的需求。

为高要求的纸托产品做好了硬件准备。

欢迎朋友们客户们莅临指导。

公司从事各类包装材料的生产,成型及手工加工等

本公司成立于2013年6月,工厂位于江苏省无锡市新吴区中通路8号中通工业园8幢,交通便利,环境宜人。

公司从事各类包装材料的生产,成型及手工加工等。我司专业生产HDPE、ABS、PET、PS、PP等各种材质的厚片及薄片吸塑制品。

积累了丰富的专业吸塑经验,公司具有专业的设计人员,为客户设计并提供解决完整的包装方案。先进的全套全自动,半自动的生产设备,为优良的品质建立了坚实的基础。打造行业内顶级品质的生产理念为客户提供贴心的服务。公司普通无尘生产车间建筑面积2000㎡,并配有200 ㎡十万级无尘室,以满足高端客户的需求。

关注最新热点,了解更多行业知识